Market price of bond calculator

Know Market Price is depressed. When it comes to investment opportunities most people immediately think of the stock market.

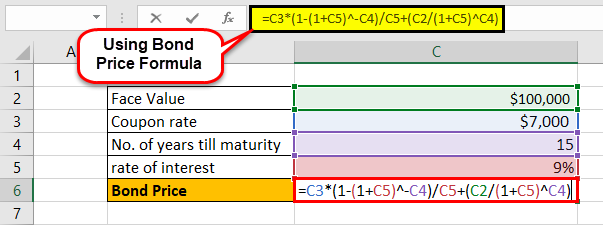

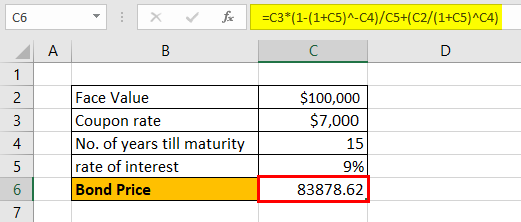

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Market interest rate represents the return rate similar bonds sold on the market can generate.

. For new issues put the par value in this field. That relationship is the definition of the redemption yield on the bond which is likely to be close to the current market interest rate for other bonds with. Bloomberg News describes this as an unprecedented loss in the long history of the bond market.

Yield to maturity based on the market price. Price to Earnings Ratio Market Price of Share Earnings per Share PE 165481191. Improvements in flexibility quality efficiency and time to market in battery production and in lithium-ion battery production machines can be initiated in numerous process steps.

Bonds Analysis by Mike Zaccardi CFA CMT covering. It sums the present value of the bonds future cash flows to provide price. Universal Index adds high yield bonds and emerging markets.

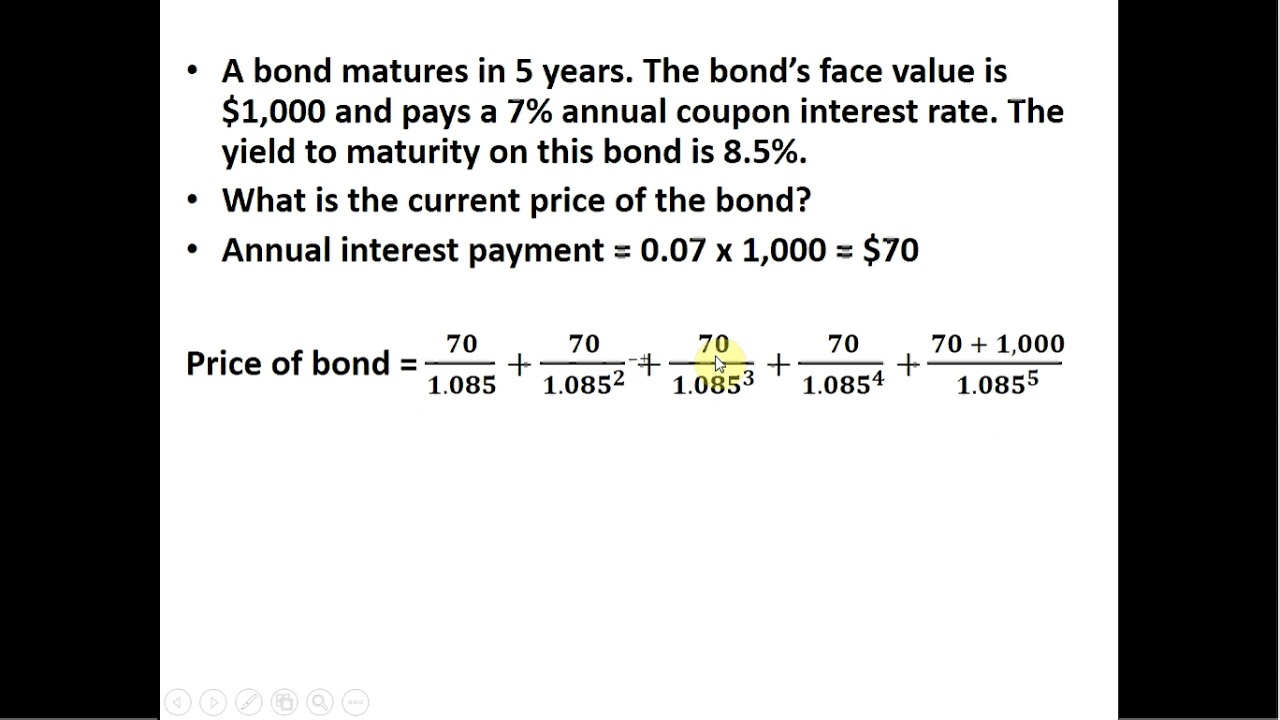

Now that we have our two inputs to the equation we just need to plug the inputs in and solve. Price to Earnings PE is one of the most popular ratios formulae that are being used by investors for valuing companies and taking investment decisions. We can also offer you a custom pricing if you feel that our pricing doesnt really feel meet your needs.

Stock Market News - Financial News - MarketWatch. The influence of behavioral biases on aggregate outcomes like prices and allocations depends in part on self-selection. The 10-year 726 2032 bond yield ended at 72135 after ending at 71859 on Thursday.

Plus the calculated results will show the step-by-step solution to the bond valuation formula as well as a chart showing the present values of the par. We conduct a series of betting market auction and committee experiments using 15 classic cognitive bias tasks. The Sovereign Gold Bond Scheme 2022-23 Series II will be open for subscription from August 22 - 26 2022.

The benchmark 10-year Indian government bond yield ended at 72318. Current Bond Trading Price - The bonds current trading price on the market. Universal Index which this fund uses as a guide to its portfolio construction.

To use bond price equation you need to input the. If you prefer to start from the bonds current market price ensure You. India bond yields up for second straight day on supply woes Sep 2 2022 0405 PM IST.

The nominal value of the. Opening up Indias corporate bond market is an important part of Prime Minister Narendra Modis pledge to almost double the size of the economy to 5 trillion by 2025. The market price of a bond is the present value of all expected future interest and principal payments of the bond here discounted at the bonds yield to maturity ie.

We document that. This calculator enables you to compare the reaction of two bonds to changes in the prevailing rate of return in the bond market. Basic Bond Characteristics.

Whether rational people opt more strongly into aggregate interactions than biased individuals. We guarantee a perfect price-quality balance to all students. What is PE Ratio Formula.

You just bought the bond so we can assume that its current market value is 965. Bloomberg Barclays bond indices include the US. In exchange for the capital.

Instead of going to a bank the company gets the money from investors who buy its bonds. Market price based on the yield to maturity. A bond is simply a loan taken out by a company.

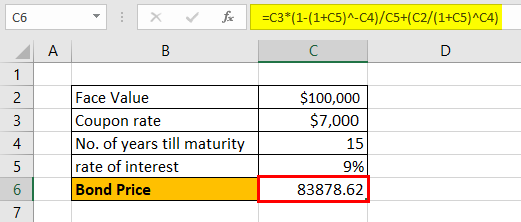

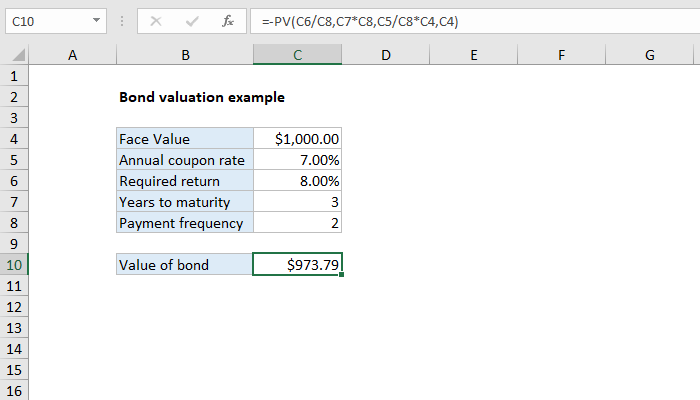

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. The ASX bond calculator has been specifically developed for bonds quoted on ASX.

The work is shown below. Once you have entered into the calculator either the market price or yield for your chosen AGB the calculator will produce the. The issue price for the next tranche of Sovereign Gold Bond Scheme 2021-22 which will open for subscription for five days from Monday has been fixed at Rs 5197 per gram of gold the Reserve Bank of India said on Friday.

US Dollar Index Futures United States 10-Year CBOE Volatility Index 10-2 Year Treasury Yield Spread. The more pages you order the less you pay. This means that if you bought the bond at its.

The current market price of the bond is how much the bond is worth in the current market place. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. Calculator Guide A Beginners Guide to Investing in Bonds.

This figure is used to see whether the bond should be sold at a premium. The yield rose two basis points on Thursday to end at 72146. Bond yields advance on Wednesday as traders bet on continued rate hikes by the Federal Reserve to battle inflation.

Read Mike Zaccardi CFA CMTs latest. ET by Vivien Lou Chen. It returns a clean price and dirty price market price.

The Bloomberg Global Aggregate Index a benchmark for the bond market worldwide has tumbled 11 from its peak in January 2021 equating to a drop of 26 trillion in the indexs market value. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator. Many factors need to come together and numerous challenges have.

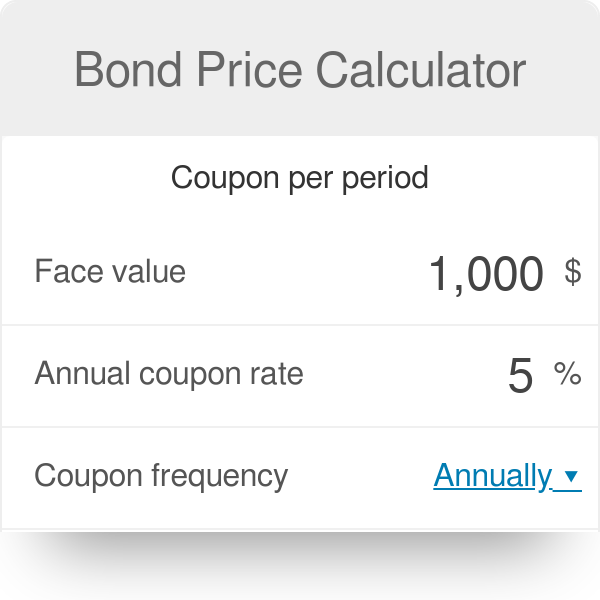

31 2022 at 401 pm. Prices move very quickly because they follow the speed at which transactions are occurring. This bond price calculator estimates the bonds expected selling price by considering its facepar value coupon rate and its compounding frequency and years until maturity.

Clean price market price less accrued. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. This lets us find the most appropriate writer for any type of assignment.

Two traders create a transaction at a purchase and sale price called the bid-ask spread Bid and ask prices drive price movement because if there is a trade that trade price disappears and the price moves to the next available one. Fine-crafting custom academic essays for each individuals success - on time. Compute Convexity Based on the Market Price of a Bond.

Figure the Market Value of Bonds.

Yield To Call Ytc Bond Formula And Calculator Excel Template

Excel Formula Bond Valuation Example Exceljet

Bond Yield Calculator

Zero Coupon Bond Formula And Calculator Excel Template

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

How To Calculate Pv Of A Different Bond Type With Excel

Bond Price Calculator Formula Chart

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

How To Calculate The Current Price Of A Bond Youtube

Bond Pricing Formula How To Calculate Bond Price Examples

Microsoft Excel Bond Valuation Tvmcalcs Com

Zero Coupon Bond Value Formula With Calculator

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Bond Yield Formula Calculator Example With Excel Template

Bond Price Calculator Exploring Finance

Bond Pricing Formula How To Calculate Bond Price Examples